| 作者 |

Market is not weak. Don't short. Market is not weak. Don't short. |

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

Market is not weak. Don't short.

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

AA's ER may add the fuel to the crazy bull. Will the market gap up open and jump over SPX 1080-1085? I don't know, but today's volumn is still low. So, bull needs to set up stop tight. Such as Fib 50 (1075).

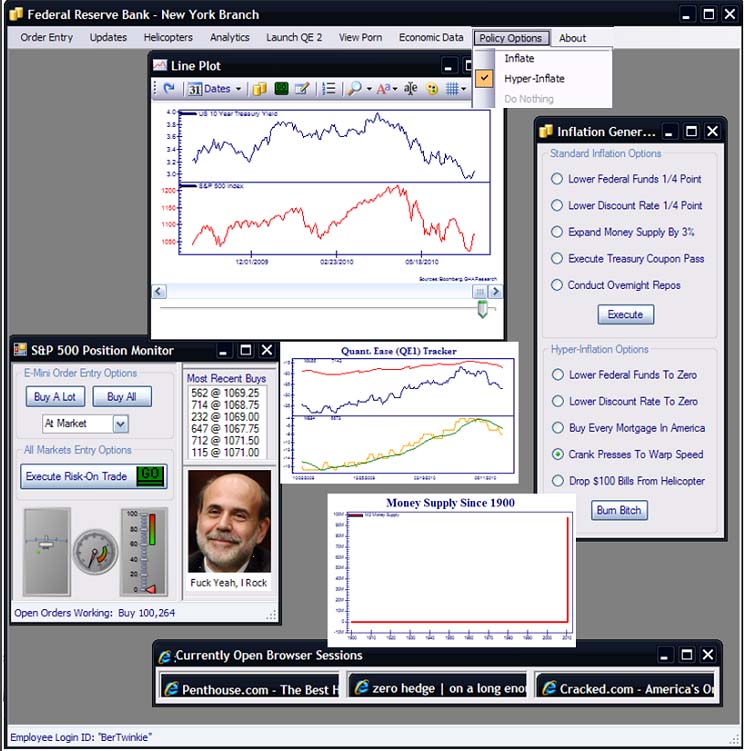

In big ben we trust, yest, we can!

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

The Monetary Base is Not Money

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

The monetary base, bank reserves plus currency, does not fulfill these functions and hence does not constitute money. To paraphrase Friedman and Schwartz, the base, which is also known as highpowered money (currency in the hands of the public and assets of banks held in the form of vault cash or deposits at Federal Reserve Banks) cannot meet these criteria. The nonbank public – nonfinancial corporations, state and local governments and households - cannot use deposits at the Federal Reserve Bank to effectuate transactions. Moreover, currency is not sufficiently broad to be considered a temporary abode of purchasing power. For Friedman, high-powered money can be properly regarded as assets of some individuals and liabilities of none. So, let us be clear on this subject. In 2008, when the fed purchased all manner of securities, to the tune of about $1.2 trillion, the fed was not "printing money". Bank deposits at the fed exploded to the upside, the monetary base rose from $800 billion to $2.1 trillion, yet no money was "printed". Deposits did not rise, loans were not made, income was not lifted, and output did not surge. The fed could further "quantative ease" and purchase another $1 trillion in securities and lift the monetary base by a similar amount yet money would still not be "printed". It is obvious the fed authorities would like to see money, income, and output rise, but they cannot control private sector borrowing. If banks were forced to recognize bad loans and get the depreciated assets into stronger more liquid hands, it could be debated on how much reserves should be in the banking system. Until that cleansing process is completed it will be a slow grind to cure the one factor which makes the fed "impotent" and unable to "print money"....overindebtedness.

Friedman and Schwartz give very specific definitions of money, definitions that are consistent with the way that M1 and M2 are currently tabulated by the Board of Governors of the Federal Reserve. The Federal Reserve calls the stock of money represented mainly by currency and checkable deposits M1.

M1 is the narrowest measure of the money supply, including only money that can be spent directly. Broader measures of money include not only all of the spendable balances in M1 but certain additional assets termed near monies. Near monies cannot be spent as readily as currency or checking account money but they can be turned into spendable balances with very little effort or cost. Near monies include what is in savings accounts and money-market mutual funds. The broader category of money that embraces all of these other assets is called M2. M2 is M1 plus relatively liquid consumer time deposits and time deposits owned by corporations, savings and other accounts at the depository institutions, and shares of money market mutual funds held by individuals. Thus, M2 is: M1 plus very liquid near monies.

Money can encompass even more than M2, including such big-ticket savings instruments as certificates of deposit whose worth exceeds $100,000 plus certain additional money-market funds and Eurodollars. The Fed no longer publishes this broader measure of money, which was called M3. M3 was M2 plus relatively less liquid consumer and corporate time deposits, savings accounts and other such accounts at depository institutions, and money market mutual fund shares held by institutions. A working definition for M3 was: M2 plus relatively less liquid near monies. Thus, the Fed, following the standards set by Friedman and Schwartz, has established money definitions that fulfill its three functions: unit of account, transaction mechanism and a store of value. The monetary base, however, does not achieve these functions and therefore is not considered money.

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

emperorfan

[博客]

年龄: 49

加入时间: 2010/02/05

文章: 2008

海归分: 814623

|

|

|

collapse of shadow banking system and securitization slows v

|

作者:emperorfan 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

| theoretical 写道: | | The Monetary Base is Not Money |

collapse of shadow banking system and securitization slows velocity.

Tightening lending standards did not help either.

from Wiki:

When the Federal Reserve announced in 2005 that they would cease publishing M3 statistics in March 2006, they explained that M3 did not convey any additional information about economic activity compared to M2, and thus, "has not played a role in the monetary policy process for many years." Therefore, the costs to collect M3 data outweighed the benefits the data provided.[15] Some politicians have spoken out against the Federal Reserve's decision to cease publishing M3 statistics and have urged the U.S. Congress to take steps requiring the Federal Reserve to do so. Libertarian congressman Ron Paul (R-TX) claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation."[20] Some of the data used to calculate M3 are still collected and published on a regular basis.[15] Current alternate sources of M3 data are available from the private sector[21]. However, some would argue [citation needed] that since the Federal Reserve has even less control over the fluctuations of M3 than over those of M2, it is unclear why this number is relevant to monetary policy.

As of 4 November 2009 the Federal Reserve reported that the U.S. dollar monetary base is $1,999,897,000,000. This is an increase of 142% in 2 years.[22] The monetary base is only one component of money supply, however. M2, the broadest measure of money supply, has increased from approximately $7.41 trillion to $8.36 trillion from November 2007 to October 2009, the latest month-data available. This is a 2-year increase in U.S. M2 of approximately 12.9%.[23]

The Keynesian side points to a major example of ineffectiveness of open market operations in encountered in 2008 in the United States, when short-term interest rates went as low as they could go in nominal terms, so that no more monetary stimulus could occur. This zero bound problem has been called the liquidity trap or "pushing on a string" (the pusher being the central bank and the string being the real economy).

作者:emperorfan 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

When the market shows the strong trend, you

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

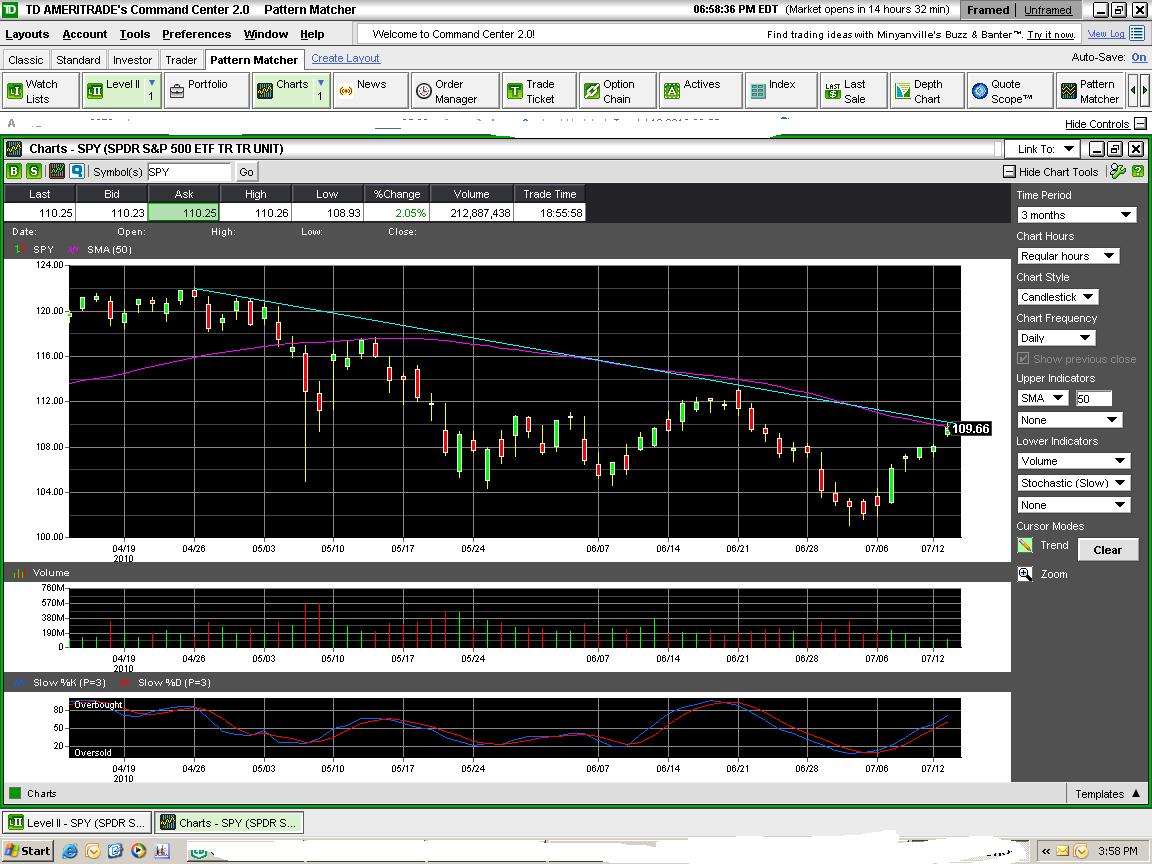

don't want to trade against it. We are in up trend, so what's the point to short. Meanwhile, QQQQ is weaker than SPY, which means the trader is not chasing high risk assets yet. Thus, even up 5 days with low volumn, the market is not crazy. Meanwhile, as usual, we gap up open jumped over 1080-1085 resistance. Now, we are facing another major resistance, trend line and 50MA. I don't think another gap up will work tomorrow.

For bulls, now, move you stop to SPX 1085 (around Fib 61. . For bears, well, good luck. . For bears, well, good luck.

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

I have no idea about tomorrow. I think the next 3 trading

|

days will show where the market will go. 200MA is around 1120, we are at 50MA now, VIX is on the support line. volumn is still low. Since I have no idea, I stay on sideline. What's the rush?

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

Watch out the trend line I draw 2 days ago. I will

|

be on vacation from tomorrow. Still, no need to bet big now.

|

|

|

| 返回顶端 |

|

|

emperorfan

[博客]

年龄: 49

加入时间: 2010/02/05

文章: 2008

海归分: 814623

|

|

|

C, BAC, JPM, GOOG not well,

|

So far only AA and INTC are strong,

It seems the 'sell on EA and then slow bleeding' prediction might work.

Have a nice vacation!

|

|

|

| 返回顶端 |

|

|

孟岛塔

头衔: 海归上士

声望: 学员

性别:

加入时间: 2006/09/23

文章: 52

海归分: 1653

|

|

| 返回顶端 |

|

|

|

|

|

|

您不能在本论坛发表新主题, 不能回复主题, 不能编辑自己的文章, 不能删除自己的文章, 不能发表投票, 您 不可以 发表活动帖子在本论坛, 不能添加附件不能下载文件, |

|

|